The Ultimate Guide to Forex Trading on MT5

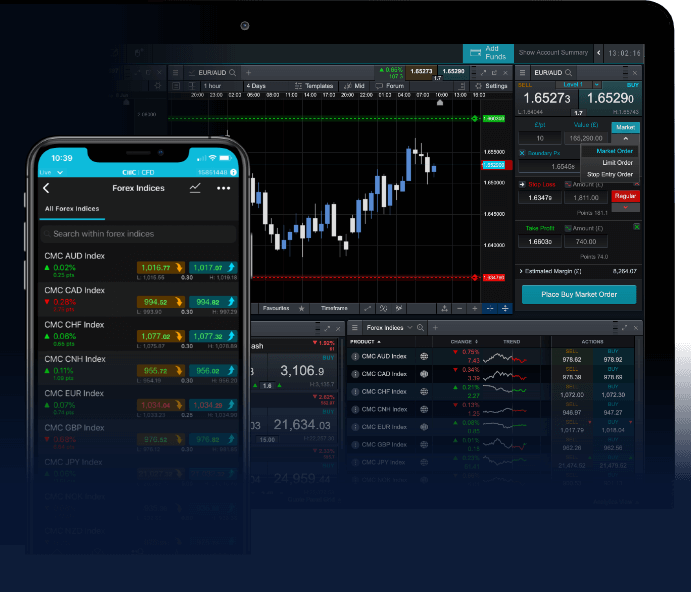

In the fast-paced world of finance, Forex trading has emerged as a popular avenue for generating income. Among various trading platforms, MetaTrader 5 (MT5) stands out due to its advanced features and user-friendly interface. In this comprehensive guide, we will explore Forex trading using MT5, understand its functionalities, and learn how to make the most of this powerful tool. For those looking for a reliable forex trading mt5 Trading Platform NG, MT5 offers unparalleled trading capabilities tailored for both beginners and experienced traders alike.

Understanding Forex Trading

Forex, or foreign exchange trading, involves buying and selling currencies with the aim of making a profit. The Forex market is the largest and most liquid financial market in the world, with a daily trading volume exceeding $6 trillion. Currencies are traded in pairs, such as EUR/USD or USD/JPY, where the value of one currency is relative to another. Traders speculate on price fluctuations to capitalize on differences in exchange rates.

Why Choose MT5 for Forex Trading?

MetaTrader 5 (MT5) was developed by MetaQuotes Software and released in 2010, succeeding its predecessor MetaTrader 4 (MT4). While MT4 remains popular, MT5 provides enhanced features that are particularly beneficial for Forex trading. Let’s delve into some key advantages of using MT5:

- Advanced Charting Tools: MT5 provides a plethora of analytical tools and indicators, enabling traders to conduct thorough market analysis. You can customize charts, add technical indicators, and perform backtesting with historical data.

- Multiple Order Types: Unlike MT4, which offers a limited number of order types, MT5 enables traders to use various order types, including pending orders, stop-limit orders, and more, giving them greater flexibility in executing trades.

- Economic Calendar: MT5 has an integrated economic calendar that helps traders keep track of key financial events, economic data releases, and news that can influence currency prices.

- Hedging Capabilities: The hedging feature allows traders to open multiple positions in the same direction, minimizing potential losses and allowing for more complex trading strategies.

- Improved Performance: MT5 is designed for faster execution speeds and improved performance, making it ideal for high-frequency trading and scalping.

Getting Started with MT5

To start trading on MT5, you will first need to download and install the platform. Here’s a step-by-step guide to get you started:

- Download MT5: Visit the official MetaTrader website or your brokerage’s site to download MT5 for your operating system.

- Create an Account: After installation, open the platform and create a trading account. You can choose between a demo account for practice or a live account for real trading.

- Familiarize Yourself with the Interface: Spend some time exploring the interface. Familiarize yourself with the different sections including charts, market watch, and the terminal for order management.

- Deposit Funds: If you are starting with a live account, deposit funds into your account through the brokerage’s supported payment methods.

- Begin Trading: Start placing trades using the order window. Set your desired parameters, such as lot size and stop-loss limits, before executing any trades.

Trading Strategies for Forex on MT5

Having a solid trading strategy in place is crucial for success in Forex trading. Below are some effective strategies that can be utilized on MT5:

1. Scalping

Scalping is a short-term trading strategy where traders capitalize on minor price movements. MT5’s fast execution speed and multiple order types are ideal for scalpers looking to make quick profits.

2. Swing Trading

Swing trading involves holding positions for several days to capitalize on expected price swings. Traders utilizing this strategy can leverage MT5’s charting tools to identify key support and resistance levels.

3. Trend Trading

Trend trading focuses on identifying and following market trends. Traders can use MT5’s technical indicators, such as moving averages, to judge market direction.

4. Fundamental Analysis

Integrating fundamental analysis with technical analysis can enhance trading decisions. Use MT5’s integrated economic calendar to stay informed about upcoming reports and news releases that can impact currency movements.

Risk Management in Forex Trading

Effective risk management is essential to long-term trading success. Here are a few risk management techniques to employ while trading Forex on MT5:

- Set Stop-Loss and Take-Profit Levels: Always utilize stop-loss orders to limit potential losses and take-profit orders to secure profits at predetermined levels.

- Position Sizing: Only risk a small percentage of your trading capital on a single trade. Most professional traders recommend risking no more than 1-2% of your account balance.

- Diversify Your Trades: Avoid putting all your capital in a single currency pair or asset. Diversifying your trades can reduce risks and offer more stable returns.

Conclusion

Forex trading using the MT5 platform provides traders with a wealth of tools and features to facilitate informed trading decisions. From advanced charting capabilities to an economic calendar, MT5 enhances trading experiences for both novice and experienced traders. By developing sound strategies and employing effective risk management, traders can harness the potential of the Forex market efficiently. Whether you’re just starting out or looking to refine your skills, MT5 is equipped to support your trading journey.